One of the topmost concerns for retailers, large or small, is now going to be on how to manage their working capital in the post COVID-19 world. With depleting cash flows on account of the lockdown, the real struggle now will be to acquire new stock, pay vendors, employees, pay back any loans, and generate enough cash flows to survive in the coming few months.

A positive cash flow helps not only in the day-to-day running of the business but helps in areas like business expansion and taking up new opportunities. Let us have a look at some ways to overcome the problem of cash flow in retail:

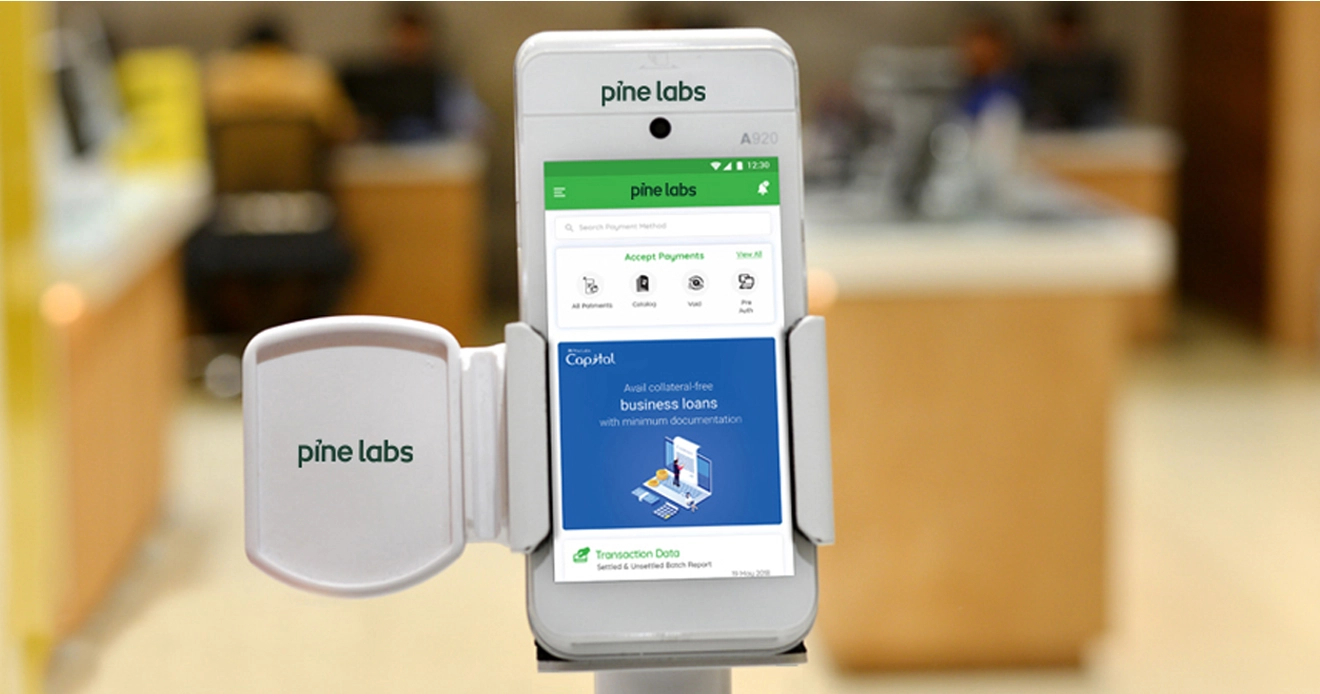

#1. Look for a PoS device which can do more than just accept payments

A feature-rich PoS machine helps in keeping a track of your daily income and expenses. Pine Labs’ Android PoS is one such smart PoS device that can also help in inventory management.

We also recommend you read: Top features to consider in a retail PoS machine

#2. Assess metrics

The right data analysis by going through the transaction history can give you a clear understanding of what products are most sought after and who your repeat buyers are. Having an insight of such trends can help you create personalised campaigns and increase your sales. Pine Labs’ Analytics solution can help you get a view of your dashboard, using which you can make data-driven decisions and keep your cash flowing in.

#3. Inspire your customers to buy more

A customer-focused approach to selling will improve your cash flows for sure. Retain your loyal customers with loyalty points. The more you reward them, the more they will buy from you. Not only this, happy customers are sure to spread positive feedback about your business in their network, something that can help you attract new customers, hence boost sales. Pine Labs’ Loyalty program helps you track your loyal customers and helps in retaining them.

#4. Encourage digital payments

As the world is going digital, it is time to make your PoS infrastructure ready to accept multiple modes of payments. Giving your customers more options to pay and in the mode of their choice will make them confident to do business with you again. By using a Pine Labs PoS machine, you can accept multiple modes of payments like UPI, credit cards, debit cards, mobile wallets, etc. Another Android-based app using which you can accept multiple modes of payment is ePOS by Pine Labs. You can now transform your Android smartphone into a payment acceptance device and accept payments anywhere, anytime.

Also read: How digital payments in India are redefining the traditional PoS

#5. Take a small business loan

Another way to increase the cashflow is by taking a collateral-free business loan. By opting for this route, you get a lump sum amount that can even be paid over by linking it with your daily sales. With such capital infusion you can choose to expand your business, purchase inventory, add new equipment or invest in a new store, or enter a new market. With Pine Labs Capital, you can navigate around the current problem of cash flows and focus on expanding your business.

To overcome the present cash flow problem, you need to be strategic in approach and should focus on how to optimise your inventory and curb daily business expenses. For requesting a PoS machine, please write to us at plutus.smart@pinelabs.com.