Digital payments are booming, set to cross $20 trillion in 2025 and projected to surge past $38 trillion by 2030. But growth comes with growing pains.

If you’re building digital products or scaling globally, you’ve likely felt them. Customers expect fast and safe payment methods. Behind that smooth front end lies a maze of decisions about infrastructure, regulation, and localisation.

Convenience is only the starting point. The true power of your payment mix lies in how well it fuels growth, meets compliance, and accelerates your path into new markets.

This blog breaks down the most popular types of electronic payment systems worldwide and why they matter to your business.

What are electronic payment systems?

Electronic payment systems are technologies that let customers transfer money digitally without using physical cash or paper-based methods.

These systems have evolved significantly. What began with magnetic stripe cards in the 1970s has expanded to mobile wallets, QR codes, virtual accounts, and even decentralised ledgers. Each new wave improves security, speed, and customer convenience.

Three major forces continue to shape this space:

- Digital transformation in finance and retail

- Widespread mobile adoption, especially in Asia and Africa

- Cross-border eCommerce, driving the need for localised payment methods

Behind many of these payment options sits the payment gateway. It plays a vital role in connecting your digital platform with banks, card networks, and wallets. This makes it easier to accept different types of electronic payment systems through a single integration.

Choosing the right gateway can help you access cutting-edge options faster while staying compliant, secure, and user-friendly.

What are the most popular types of electronic payment systems globally

Here’s a look at the most widely adopted types of electronic payment systems used around the world, along with their benefits and limitations.

1. Card-based payments

Still a global staple, especially in the US and Europe.

- Examples: Visa, Mastercard, American Express, RuPay

- Benefits: Trusted, globally accepted, secure

- Limitations: Higher processing fees, slower settlements, and fraud risks

2. Mobile wallets & super apps

Gaining dominance in Asia and growing fast globally.

- Examples: Apple Pay, Google Pay, Alipay, Paytm

- Benefits: Fast checkouts, integrated loyalty, mobile-first UX

- Limitations: Limited acceptance in some countries, dependency on smartphone access

3. Bank-based payments

Direct, real-time transfers are gaining momentum across regions.

- Examples: India’s UPI, Europe’s SEPA, ACH, NEFT

- Benefits: Low cost, real-time settlement, secure

- Limitations: Requires account linking, not ideal for one-click checkout

4. Buy Now, Pay Later (BNPL)

A game-changer for affordability and conversions.

- Examples: Klarna, Afterpay, ZestMoney

- Benefits: Credit-layered checkout, interest-free EMIs, reduces drop-offs

- Limitations: Risk of over-lending, regulatory scrutiny in some markets

Platforms using affordability tools like no-cost EMIs, custom discounts, and instant offers can reach more users, reduce CAC, and improve revenue.

5. Cryptocurrencies & stablecoins

Gaining traction in LATAM, Africa, and Web3 communities.

- Examples: Bitcoin, USDC, Ethereum

- Benefits: Borderless, fast, programmable

- Limitations: Volatility, regulatory uncertainty, limited mainstream use

6. Biometrics & tokenised payments

Securing the future of frictionless commerce.

- Examples: Face ID, fingerprint payments, tokenised cards

- Benefits: High security, low fraud

- Limitations: Infrastructure-dependent, privacy concerns in some regions

Regional variations in payment preferences

Global rollout of a product? You need more than translation; you need payment localisation.

Payment behaviours vary sharply across regions:

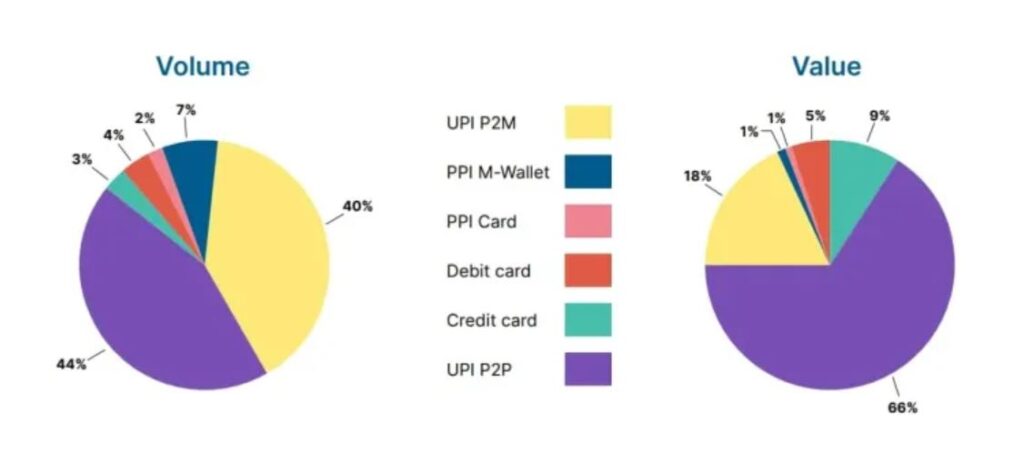

- India: Over 80% of all digital transactions happen via UPI, with QR codes and mobile wallets driving micro-payments. Mobile-first interfaces win here.

- US: Card payments still account for nearly 70% of total eCommerce sales. BNPL options like Klarna and Afterpay are increasingly preferred by Gen Z and millennials for flexibility.

- Europe: Europe’s payment landscape is shaped by SEPA, PSD2, and strong Open Banking regulations. Consumers often use direct account transfers or fintech apps linked to their banks.

- Africa: M-Pesa leads mobile money adoption, especially in Kenya and Ghana. Many users skip traditional banking entirely and transact via feature phones.

- China: Over 90% of digital payments happen via super apps like Alipay and WeChat Pay. These platforms bundle social, shopping, and financial tools in one place.

To improve conversion and trust, you must align with these local preferences. That means offering the right types of electronic payment systems tailored to each region.

Why businesses must support multiple payment systems

One payment method doesn’t fit all, especially when your customers span countries, devices, and income groups.

Here’s why offering multiple types of electronic payment systems is now a strategic imperative:

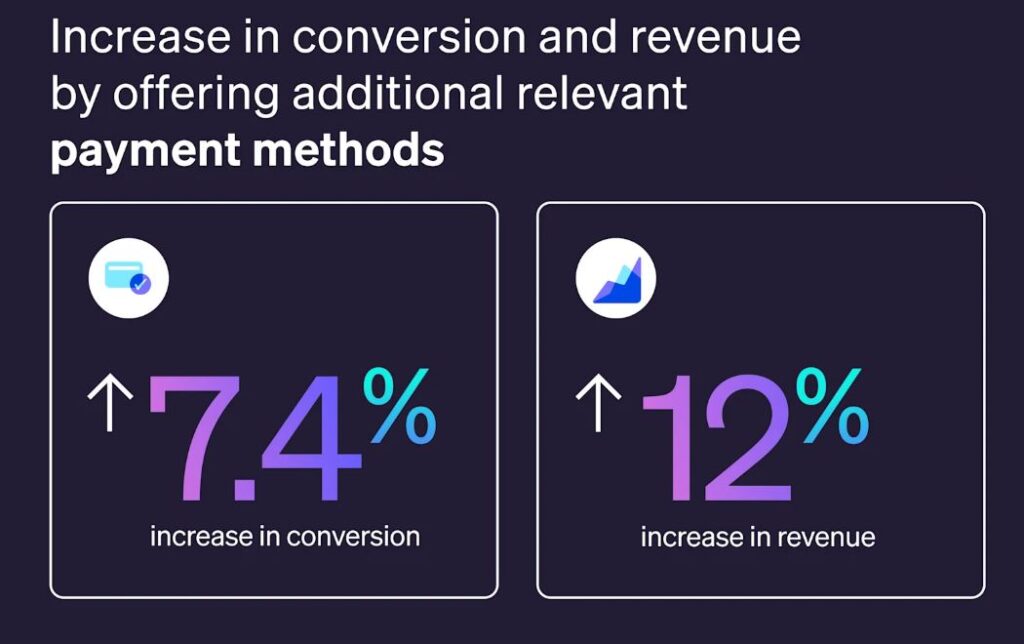

- Increase conversions: When users find their preferred payment option, they’re more likely to complete the transaction.

- Lower cart abandonment: Lack of local options is a top reason for checkout drop-off, especially in cross-border sales.

- Build trust instantly: Familiar payment methods improve credibility with new users.

- Expand global reach: Offering region-specific systems like UPI or SEPA helps you serve wider audiences.

- Support user diversity: Users have different spending habits. Some prefer credit cards, others opt for wallets or BNPL.

- Ensure continuity: Multiple systems offer fallback options in case of gateway downtime or bank outages.

You’re not just offering a transaction; you’re designing an experience. By enabling varied payment modes—cards, wallets, bank transfers, and more—you make your checkout future-ready, accessible, and user-centric.

This approach also improves operational resilience, especially as electronic payment systems evolve rapidly in global markets.

What the future holds for electronic payments

Electronic payments are entering a phase where context, identity, and experience converge.

- Voice assistants and wearables: These will soon become primary interfaces. You’ll see tokenised payments linked to biometrics—think smartwatches or voice-activated checkouts—powered by secure, consent-driven technology.

- Open Banking APIs: These are streamlining how users access their accounts across platforms, while biometric wallets reduce fraud and password fatigue.

- Central Bank Digital Currencies (CBDCs): These are gaining traction, too. Over 134 countries are exploring CBDCs, with India, China, and Nigeria already testing them.

- Web3: In Web3 ecosystems, payments are merging with self-sovereign identity. Your customers may soon unlock services based on wallet-linked reputation and credentials.

To stay ahead, you need agile systems that support both existing and emerging types of electronic payment systems, from UPI to blockchain-led wallets.

Final thoughts: Stay ahead by understanding global payment trends

You can’t afford to rely on a single method anymore. The most successful businesses today offer multiple types of electronic payment systems tailored to local markets.

From India’s UPI to Europe’s SEPA and Africa’s mobile wallets, staying informed helps you build faster, more intuitive payment experiences. It also prepares your business for what’s next—biometrics, tokenisation, CBDCs, and more.

At Pine Labs, we simplify this complexity for you. Our future-ready payment solutions help you accept 100+ payment modes, offer Pay Later options, launch real-time offers, and grow revenue across channels. Whether in-store, online, or omnichannel, we help you scale faster.

Ready to offer a smarter payment experience across markets? Contact us today!

Write to us at pgsupport@pinelabs.com to explore how our platform can help your business thrive globally.