A startup founder in Bengaluru recently lost a global customer. Not because of product issues, but because her payment gateway in India couldn’t process a crypto transaction. Stories like hers are becoming common as India’s digital economy collides with the rapid rise of Web3.

The Web3 e-commerce and retail market is projected to skyrocket from $18.98 billion in 2025 to $565.16 billion by 2034. A 45.8% CAGR points to massive disruption ahead. As decentralised commerce gains traction, traditional payment systems face mounting pressure. They’re fast, yes. But are they flexible, secure, and future-ready?

From NFTs to smart contracts, the borderless economy is already here. The question is: can your payment stack handle what’s next, or will it be left behind in yesterday’s code?

Let’s take a closer look.

Web3 commerce: What’s changing and why it matters

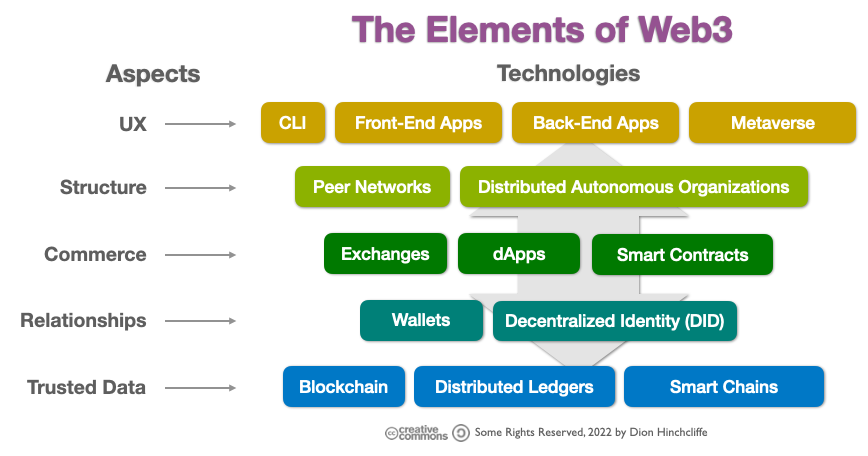

Web3 represents a paradigm shift in how value is transferred. Your users are exploring NFTs, crypto wallets, and dApps not as novelties, but as new channels of interaction and ownership.

Here’s what’s changing:

- dApps and smart contracts remove intermediaries and enable direct peer-to-peer exchanges.

- Digital assets and tokens allow programmable incentives and micro-rewards in real time.

- Wallet-native users are shaping new commerce models, driven by ownership, not loyalty points.

India’s internet base is already ahead. With over 115 million crypto users and growing adoption of tokenised communities, your next customers could pay in USDT or store loyalty in NFTs.

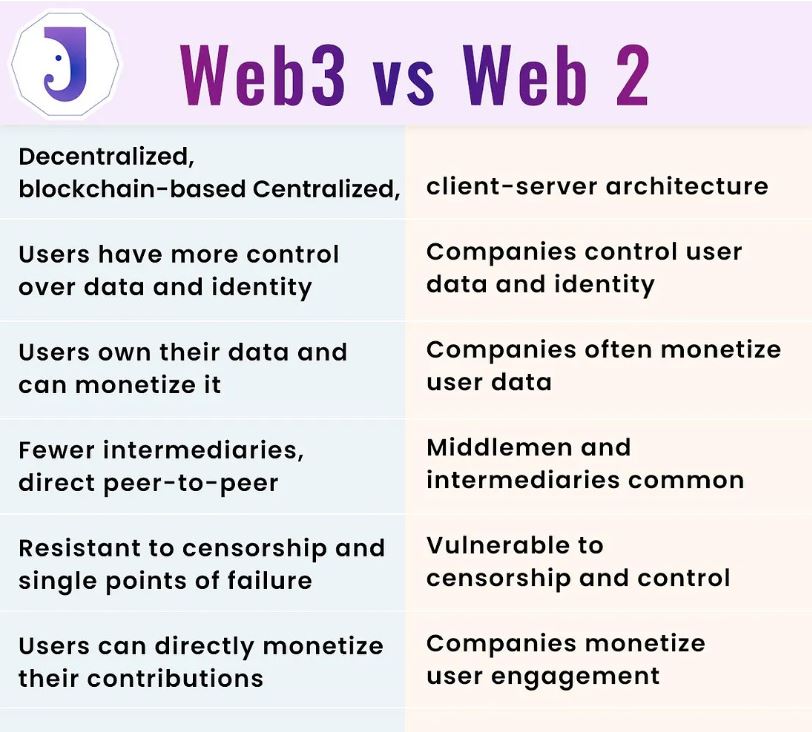

Web3 commerce shifts from centralised platforms to decentralised protocols. It’s borderless, real-time, and identity-led. In this model, you don’t own the user journey; you co-create it. Payment gateway India providers must adapt to this shift, moving from rails that process transactions to ones that enable programmable trust.

Why current payment gateways in India are at a crossroads

While India leads in digital adoption—UPI transaction volumes hit 18.68 billion in May 2025—Web3 demands more than volume. It demands compatibility, flexibility, and a new architecture altogether.

Here’s the challenge you face:

- High MDRs aren’t sustainable for microtransactions or streaming payments used in dApps.

- Rigid pricing doesn’t fit with programmable incentives or token-based models.

- Limited crypto support blocks seamless on-chain transactions.

- Few gateways offer interoperability with Web3 wallets or decentralised identity systems.

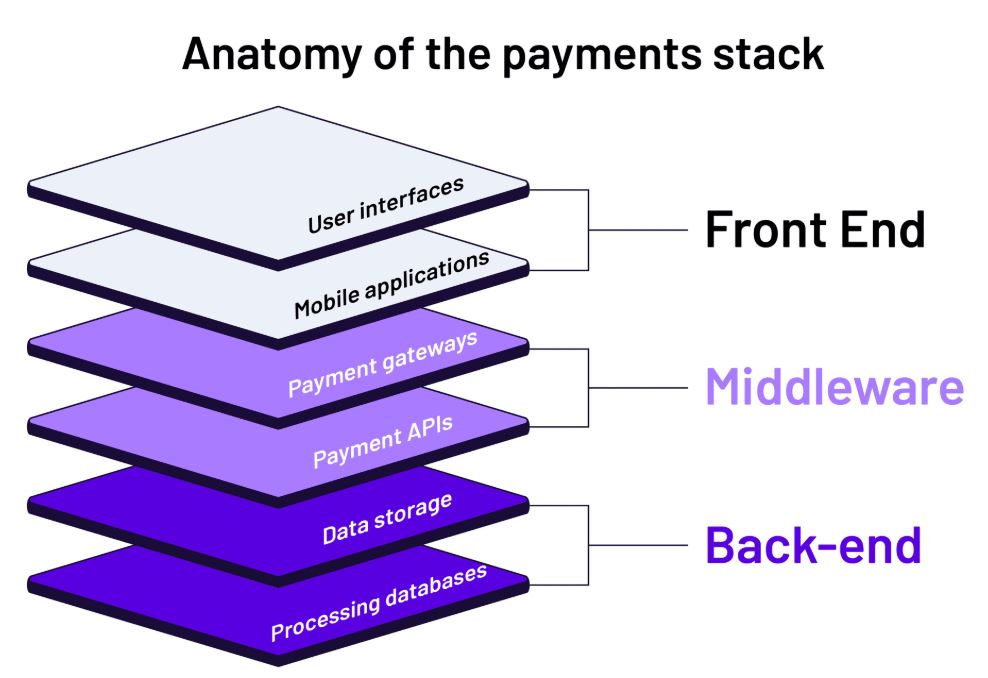

Most payment gateway India providers are still optimised for fiat rails, not token networks. Web3 doesn’t run on Visa or Rupay; it runs on smart contracts and self-custody.

To stay relevant, your payment infrastructure must evolve. You need systems that support:

- Gas-efficient micro-payments

- Cross-chain settlement

- Embedded compliance for decentralised commerce

India’s regulatory environment still restricts crypto acceptance, but innovation can’t wait. You need a gateway that’s future-aware, if not fully future-ready. Because your next-gen user won’t wait for infrastructure, they’ll move to where it already exists.

What a future-ready Indian gateway must offer

As Web3 evolves, your business needs a payment gateway India solution that’s programmable and decentralised by design.

Here’s what it must offer:

- Multi-asset support: Accept stablecoins like USDC or INR-tied tokens, alongside fiat and digital vouchers.

- Smart contract compatibility: Enable automated payments: royalties, affiliate payouts, or milestone-based SaaS billing.

- Real-time interoperability: Use APIs that sync with Web3 wallets like MetaMask, Phantom, or OKX. Let users pay from anywhere, instantly.

- Compliant innovation: Integrate KYC, AML, and GST tracking tools to meet India’s evolving crypto policy framework.

There’s no slowing down in Web3 commerce. From gaming tokens to NFT-based access and DAO-driven payments, user expectations are evolving fast. A payment gateway that only supports platforms won’t be enough. It needs to speak the language of protocols.

The opportunity is bigger than the domestic market. You’re creating infrastructure for a globally connected generation that’s already living in the digital future.

If your payment setup in India only handles transactions, it’s already behind. Modern commerce calls for systems that can power programmable experiences. The new baseline is agility, interoperability, and built-in compliance.

Use cases that will drive Web3 in India

Web3 is already driving payments across key sectors in India. Your platform must evolve to meet these dynamic, decentralised demands.

Here’s where the real action begins:

- Gaming and metaverse: India has over 591 million online gamers. They expect seamless token-based purchases, asset portability, and cross-border in-game spending.

- Creator platforms: Whether it’s music, digital art, or video, smart contracts can automate royalty payouts and protect creator IP. India’s creator economy is expected to surpass $1 trillion by 2030.

- Decentralised marketplaces: Peer-to-peer commerce with built-in trust layers. Escrow-based smart contracts ensure automatic settlements, and no platform middlemen are required.

- SaaS and global productivity tools: Offer recurring billing in stablecoins. Serve clients in Dubai, Berlin, or New York with real-time, gas-optimised micro-payments.

- NFT ticketing and events: Replace QR codes with NFTs. Offer programmable access, resale logic, and proof-of-attendance records.

What does this mean for you?

You need a payment stack that’s programmable, currency-agnostic, and regulation-aware. Your gateway must support tokenised billing, automated splits, and on-chain receipts.

The future of commerce in India is no longer limited to cards and UPI. It’s shaped by wallets, tokens, and smart contracts. From Bengaluru’s gaming startups to Delhi’s SaaS giants—everyone needs a payment gateway India solution that works across on-chain and off-chain worlds.

This isn’t an upgrade. It’s a redesign for future scale.

The regulatory path: Key challenges to watch

You’re building for speed, but regulation moves at its own pace. In India, your payment gateway must balance agility with compliance readiness.

Here’s what you need to track:

- RBI’s digital currency framework: While the RBI has introduced the Digital Rupee, private crypto use in payments still faces restrictions.

- NPCI’s blockchain pilots: NPCI is exploring distributed ledger use cases for settlement. Early alignment with these efforts is key.

- Tax and KYC compliance for tokens: Clear frameworks for GST, capital gains, and wallet-level KYC are still developing.

So, what can you do today?

- Choose gateways that are built with regulation in mind, offering tools for AML, GST tagging, and decentralised ID checks.

- Stay nimble. Adopt modular stacks that allow quick upgrades when policy unlocks stablecoin or tokenised use cases.

- Test hybrid payment flows: off-chain initiation, on-chain settlement, and compliant reporting.

The payment gateway India landscape is evolving. Staying ahead means preparing for clarity while building for change. You don’t need to wait for green lights, just architect for adaptability.

Final thoughts: The future of the payment gateway in India is programmable

Web3 is a new way to move value. The winners will be businesses that blend compliance, flexibility, and real-time digital payments. As a digital platform, you need infrastructure that supports programmable flows, tokenised assets, and smart contracts, all while staying compliant in India’s regulatory ecosystem.

At Pine Labs, we’re helping forward-thinking businesses like yours lead this shift. Our technology-first solutions—from real-time analytics to stable, multi-channel payment support—are built for the next decade of commerce.

Let’s make payments smoother, smarter, and more scalable for your customers. Contact us today!

Looking for a payment gateway India solution that’s ready for the Web3 era? Write to us at pgsupport@pinelabs.com to learn how we can help.